Except for a home, an automobile is the largest single investment that most families will ever make. It’s often the biggest drain on the household budget because while most homes increase in value over the years, most cars depreciate in value. Public transportation in many parts of North America is inadequate, so that for many people, owning a car is essential for getting to work, shop ping, and leading a normal social life. The following discussion will show you how to calculate this major cost of living and should help you to keep your driving costs as low as possible.

Contents:

- Calculating driving costs

- How to sell your old car

- Buying a new car

- How to find a good used car

- Road testing a used car

- Shopping for the best car loan

- Leasing vs. buying

- Driving for maximum economy

- How to handle road emergencies

- Buying auto insurance

Driving costs/Calculating costs

What does it alt add up to?

Most car owners are aware that it’s becoming increasingly expensive to own and operate an automobile, but many have only a vague notion of exactly how big a bite a car takes out of the family budget.

The traditional North American family car—a four-door sedan with V-8 engine, automatic trans mission, air conditioning, and other customary accessories—now costs over $8,000 to buy. During the typical 10 years and 100,000 miles that it will be driven, the car will cost its owner more than $33,000. Assuming that the vehicle is kept by its original owner and sold for scrap at a nominal fee when it’s no longer serviceable, the entire $8,000 purchase price will be lost. In addition, it will cost over $5,000 in maintenance and repair costs, over $13,000 for fuel and oil, almost $900 for replacement tires, at least $3,000 for insurance, and more than $2,000 for registration, parking, garage fees, and tolls.

These figures, shown in Tables 1 and 2 at the right, are based on methodology developed by the Highway Statistics Division of the U.S. Department of Transportation (DoT). The figures have been updated to reflect 1980s costs, but they are just estimates. The work sheet found in Table 3 is designed to help you calculate your own driving costs.

A typical car passes through two, three, or more owners during its 10-year, 100,000-mile lifetime, but the costs of these changes in ownership, because they are so varied, were not estimated in the DoT study. According to the DoT, it’s cheaper to buy a new car and keep it running for 100,000 miles than it’s to trade it in for a new model. The need for repairs, or the anticipation of repairs, usually prompts the sale of a car, often through a new- or used-car dealer. As cars become older, they travel fewer miles per year, either because they are used as second or third cars in multi-car families or because they are sold to new owners who don’t drive much and therefore don’t feel the need for a brand-new car.

Fixed ownership costs:

The cost of a car can be broken down into two categories: the fixed cost of ownership, which you pay whether you use the car or not, and the variable cost of operating the car, which is determined by the number of miles you drive each year.

Ownership costs include the purchase price of the car, insurance, garaging, and license and registration fees. The purchase price is the most obvious cost, and the least understood. Many people feel that if a car costs $8,000 to buy, that $8,000 is irrevocably lost. But this is not true unless you keep the car until it’s a worthless hulk. Most people sell their cars after a few years and recover a portion of the purchase price, although the amount often takes the form of a trade-in allowance on the purchase of their next car, which is not so obvious or gratifying as cash in hand.

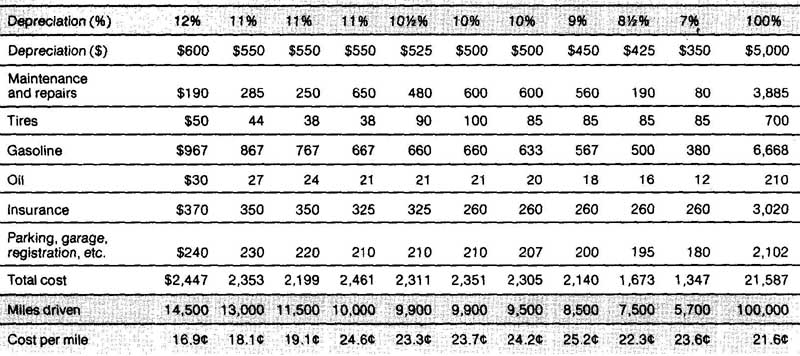

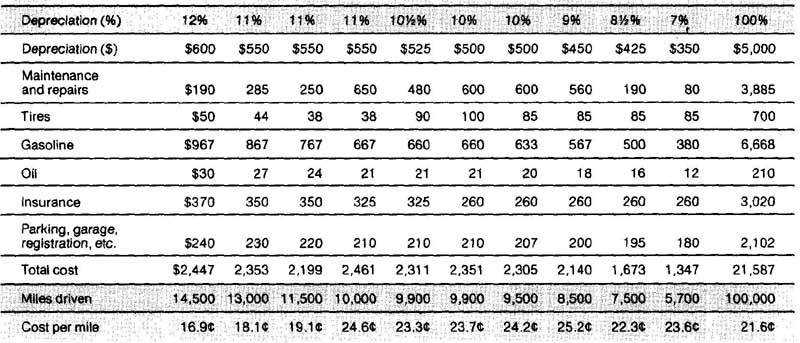

Table 1: Small car ($5,000 purchase price, 30 mpg): YEAR OF OWNERSHIP

Table 2: Large car ($8,000 purchase price, 15 mpg): YEAR OF OWNERSHIP

If that $8,000 car were sold after several years for $3,000, its real cost would be only the difference between the original purchase price and the selling price, or $5,000. This difference is called depreciation, and it’s one of the most important concepts to understand regarding car ownership costs.

Any calculation of depreciation is purely theoretical. You won’t know exactly how much your car has depreciated until you sell it. If you get less than you might have for your old car, it will have cost you more to own than if you had held out for a higher price. This may seem fairly obvious now, but it’s a truth that is often forgotten during the hectic price negotiations for a new car.

As a general rule, you can expect to lose one-third to one-half the value of your new car within the first 3 years, which is why the DoT recommends driving your car for 10 years before selling it. Depreciation is always “front loaded”—that is, your c loses value more rapidly at the beginning of its life. Buyers who trade in frequently lose this money.

Some cars depreciate more quickly than others. The DoT tables show a big car depreciating 25 percent during the first year of ownership, 15 percent the second year, and lesser amounts each subsequent year. Depreciation on the small car in the DoT study was 12 percent the first year, then evened out to between 11 and 10 percent for the next six years. Although these figures are typical for big luxury cars and small economy cars, the rate at which a particular car depreciates depends on how well the car was cared for, how many miles are on the odometer, and how popular the car model is.

Car models that are in high demand or have a good reputation for reliability will depreciate less than the average car. In some recent years, because of inter national monetary fluctuations, the prices of new German and Japanese cars rose sharply, and this made many used German and Japanese models more valuable than they would otherwise have been. In a few cases, used cars increased in value—a particular two- or three-year-old model sold for more money as a used car than it had cost new.

Such situations are rare and difficult to predict, however. The best way to ensure maximum resale value on a car you presently own is to keep it in good repair and to avoid putting unnecessary mileage on it. If you are buying a new car, pick one that is popular (commonly seen) and has a good reputation for durability (check the frequency-of-repair records in consumer publications). Exotic cars with small, loyal followings can have a high resale value, if you can find a member of that small following who wants to buy a used model. Otherwise, these oddball cars may be difficult to sell at all. For more advice on reducing the cost of depreciation, see How to sell your old car.

Insurance costs vary greatly, depending on the amount of coverage you are willing to pay for, the make and model of the car, its age, the area in which you live, and your driving record. A more detailed discussion of insurance costs. In general, the smaller, less expensive, or older the car you drive, and the fewer miles per year it’s driven, the less it costs to insure.

Finance charges include the interest you must pay on an auto loan, or the interest lost on money that is withdrawn from savings accounts or other investments in order to pay cash for a car. Because there are so many possibilities—cash purchase, various auto loans, or leasing—no attempt has been made to include finance charges in Tables 1 and 2. There is room for these calculations in Table 3, however, and you should enter your own finance charges there when figuring total costs. For more information on finance charges, see our topical discussion.

Local taxes and fees vary widely from area to area but are part of the fixed ownership costs, since they don’t depend on the number of miles a car is driven each year. Most states have annual registration fees, plus a fee that is paid each time your driver’s license is renewed. In some regions an annual use tax is also levied on each vehicle, or there is a personal property tax that is calculated as a percentage of the car’s depreciated value. There may also be state or local sales taxes and title fees, which are usually paid every time a car changes ownership. These last two fees are not included in Tables 1 and 2 but should be entered in 1äble 3 for the first year a car is owned.

Any sales tax paid on a new car may be deducted from your gross income when computing income taxes. The amount of money you save here depends on the amount of the sales tax and on your personal tax bracket. For example, if you pay $400 in sales tax and are in a 25 percent income tax bracket, deducting $400 from your gross income will save you $400 times .25, or $100. If you are in a 30 percent bracket, it will save you $400 times .3, or $120.

Variable operating costs:

The most obvious operating expense is the cost of fuel and oil. Both cars were assumed to run on gasoline that cost $2 per gallon. The large car was assumed to average 15 miles per gallon (mpg); the small car, 30 mpg. They were assumed to use oil at the rate of one gallon of oil for every 167 gallons of gasoline (large car) or every 120 gallons of gas (small car). Oil was figured to cost $1.50 per quart.

You can calculate your own fuel use in one of two ways: One way is to keep a record of every fuel purchase and add up the total for the year. It’s a good idea to keep a log of all your operating costs by entering them into a small note book that you keep in the car. Every time you spend money on the car, note the date, the mileage on the odometer, what was done or added to the car, and the price. This record will help you to calculate your actual operating costs and to keep track of routine maintenance intervals. When you sell the car, its log book can impress prospective buyers with the care that the car has had.

This log book will also enable you to calculate your car’s gas mileage. If you fill the tank every time you add gas, you can figure out your fuel mileage from the log entries as follows:

Keep a log of car costs in a note book that you can carry in the glove compartment. This will keep you aware of your car’s operating costs and serve as a reminder of when routine service was last performed and, therefore, when it’s due again.

To compute the total miles traveled, subtract 29,562 from 30,106 (which equals 544 miles). To find the amount of gas consumed, add all the fill-ups except the first one at 29,562. That gives you 9.5 plus 11.4, or 20.9 gallons. Divide the mileage by the gallons (544 by 20.9) to get the miles per gallon (26.02 mpg). If you divide the total cost ($19.00 plus $22.80) of the 20.9 gallons by the mileage (544), you will get the cost- per-mile for fuel (7.7 per mile).

If you calculate your fuel mileage for typical driving and know about how many miles you drive each year, you can project your fuel consumption for years to come. For example, if you get 26 mpg and drive 12,000 miles a year, each year you will use 12,000 divided by 26, or 462 gallons of gas. Multiply 462 by the price per gallon in your area, and you will have a rough estimate of your fuel cost per year. (This estimate does not take into account unpredictable changes in the price of fuel.)

The DoT calculations assume that the cars were supplied with radial tires, and that four new radial tires and four new radial snow tires will be purchased during the life of each car. Two extra wheels and two of the snow tires were considered first-year purchases. The cost of tires was spread out over the life of each tire. Tire costs take a jump from the fifth year onward, when the first group of seven tires wears out at about the same time.

Maintenance and repair calculations include routine maintenance items such as lubrication, tune-ups, adjusting headlights, flushing cooling systems, and so on, at the intervals recommended by car manufacturers. Repairs include brake jobs, replacing the water pump and universal joints, carburetor over haul, and a valve job, all at typical intervals. It was assumed that all work was done by professional mechanics at a labor charge of $20 per hour.

Cutting costs:

One obvious way of cutting down on car costs is to do much of the maintenance and repair work yourself, and that is what this guide is all about. Tips on being your own mechanic and setting up shop are found later in this guide. Hints on getting the best work from professional mechanics are found later in this guide.

It’s also obvious from Tables 1 and 2 that a small car costs much less to own and operate than a large one. It uses less fuel, and the tires, batteries, and many of the other parts a small car requires also cost less. Most small engines hold less oil and antifreeze than large ones. Registration, parking, and insurance fees are sometimes lower for small cars, too. How ever, a small car will usually sustain more damage in an accident than a large car, and therefore cost more to repair. Owning a small car may be impractical for people with large families, car pool commitments, or certain business needs. Because fuel is one of the largest and fastest-growing car costs, it pays to shop for a car with the best fuel economy you can find, whatever the size of the car.

When using Table 3 to calculate your driving costs, make a photo-static copy of p.12 for each car you own, then fill in lines 1 through 12. If you can find out the current resale price of your car, enter it on line 13; otherwise, use Table 1 or 2 to estimate depreciation. If you don’t know how many gallons you use each year, fill in line 17 by calculating your car’s mpg and dividing it into your annual mileage. Line 20 is an estimate of future repair costs based on the cost of labor in your area. If you have a four -year-old big car, use the repair cost of $825 from Table 2 for this calculation. If you do half the work on your own car and the labor charge for the rest is $25 an hour, divide $25 by 2 and enter that ($12.50) on line 11.

Table 3: How to calculate your ownership costs

Work sheet:

1. Purchase price (or down payment) $ __________

2. Sales tax on purchase $ __________

3. Monthly installment payments (if any) $

4. Cost of a tire that fits your car $ __________

5. Price of fuel (per gallon) $ ___________

6. Price of oil $ __________

7. Annual insurance premium $ __________

8. Estimated daily parking cost $ __________

9. State annual registration fee $ ____________

10. Annual title fee, use tax, or property tax on your car $ __________

11. Mechanics hourly labor charge in your area $ __________

12. Miles driven per year ___________ miles $ __________

Ownership costs---YEARLY COST

13. Depreciation (% of original cost from Table 1 or 2) $

14. Insurance (line 7, above) $ __________

15. Registration fees (lines 9 and 10, above) $ __________

16. Finance charges (12 x line 3) $ __________

Operating costs:

17. Fuel cost (annual gallons x line 5) $ ___________

18. Oil (line 12 + your oil change intervals x line 6) $ ___________

19. Tires (line4 + 2) $ _________

20. Maintenance and repairs (line 11 + $20 x maintenance and repair cost in Table 1 or 2) $ __________

21. Parking (250 x line 8, or actual days parked x daily cost) $ __________

22. Total cost per year (add lines 13—21) $

23. Cost per mile driven (line 22 * line 12) ___________ C

Driving costs/Selling a car

How to sell your old car:

Every used car has two price tags: wholesale and retail. The wholesale price is the lower of the two; it’s the amount a dealer will pay for a car. The retail price is the amount the used-car dealer will ask for a reconditioned car. The difference between these two prices pays for any repairs the dealer must make on the car and includes his profit. To get an idea of the wholesale price of your car, ask a few used-car dealers what they would pay for your car. For the retail price, look at the prices of models like yours in used-car lots and classified newspaper ads. Keep in mind that these are only asking prices and that the actual selling prices are usually a few hundred dollars less. There are newsstand publications that list approximate retail and wholesale prices for used cars. The National Automobile Dealers Association (NADA) Official Used Car Price Book also lists wholesale and retail prices. These “official” prices are strictly theoretical, however—a composite of average prices from all around the country. They can only approximate the precise value of your car.

A quick sale to a used-car dealer can have its advantages, but a high price is not one of them. A dealer must offer a lower price because he has expenses to cover: initial car repairs, warranty repairs, and business overhead that includes rent, utilities, insurance, and employee benefits. If you are in a hurry and must sell to a dealer, always show your car to several dealers and take the best offer. A dealer will usually offer more for a trade-in than for a straight sale, but the difference will always be added to the price of the new car you buy from him.

If you are going to sell the car privately, be realistic about your asking price. Being fair about the selling price will save you time. If too much time is wasted trying to sell the car, you could lose some of its real value through additional depreciation. If the car is not in good condition or is minimally equipped, pick a price closer to the wholesale value of a car like yours. If it’s in good shape and well equipped, ask for a price closer to its retail value. Have two prices in mind—the highest you think you can reasonably get for your car and the lowest you are willing to take. Keep in mind that you are in competition with the used-car dealer who charges full retail price but who has fixed the car up and offers a warranty. Advertise the higher price, but be prepared to settle for a price between the two. Place ads in local newspapers and on office or supermarket bulletin boards. A For Sale sign in your car window can be effective if it includes both your phone number and asking price. When writing a newspaper ad, be as concise as possible; the fewer words you use, the lower the cost. List only your phone number, not your address or name, in order to prevent thieves from stopping by.

By far the best way to sell a used car in most counties is through local classified advertising publications and Internet resources such as the eBay Motors, Craig’s List, Pennysaver, AutoTrader, etc. Be sure to include your asking price in any ad; this will save answering unnecessary phone calls, emails or text messages to explain your price. Be honest in describing the car to callers. You must also be prepared to spend time showing the car to prospective buyers and doing the necessary paperwork for the title transfer. Make sure you have done all the right paperwork before you even think about selling your car. There is no point in having the car sold, only to find that you have lost the title and cannot complete the deal.

To get the highest price for your car, spend a weekend cleaning it up and doing minor repairs. A coat of wax, a vacuumed interior, and shiny chrome can add hundreds of dollars to the price you get for your car. Don’t forget to clean the upholstery, doors, headliner, and windows. Empty the glove compartment and trunk, too. You can clean the engine with an aerosol degreaser. Check all the fluid levels. If the oil is black and dirty, change it. Clean the battery terminals and properly inflate all tires, including the spare. Check to see that all lights are functioning.

When showing your car to prospective buyers, be honest about its condition and defects. By doing this, you will be covering yourself against any future complaints if the car proves to be defective. Collect all your bills for repairs done on the car. That way, a buyer can see proof of regular service and recent repairs. If your car is still under warranty, have your maintenance record available. If a prospective buyer wants to take the car for a test drive, let him do so but go along with him to prevent the car from being stolen or abused. Present your car as honestly as you can. Remember, however, that all used cars are sold ‘as is,” and you have no liabilities to the new owner unless he can prove deliberate fraud.

Classified ad abbreviations:

A/C, or air - air conditioning

AT - automatic transmission

bbl - carburetor barrel (2-, 4-)

CB - citizens band radio

conv - convertible

cpe - coupe

Cyl - cylinders (4-, 6-, 8-) dir - dealer

dr - doors (2-, 4-)

hdtp - hardtop

loaded - fully equipped

lo mi - low mileage

man - manual

o.n.o. - or near offer, obo – or best offer

pb - power brakes

p.s. - power steering

pw - power windows

sacr – sacrifice

sed – sedan

spd – speed

std – standard transmission

sun rf - sunroof

CD - CD player

tr – transmission, trans – transmission

vnyl - vinyl top

wrnty – warranty

wgn - station wagon

Never accept a deposit unless you are prepared to sell your car to that person at the agreed price. When accepting any deposit or payment for a car, insist on cash or a certified check. If you are still making loan payments on the car you are selling, you will have to pay off the loan before the car can be transferred to the new buyer. Once the loan is paid in full, the bank will release its lien and sign over the title of owner ship to you. You cannot transfer title to the new buyer until this is done.

The certificate of title is only one of the legal papers you must have ready when selling a car; in most states the vehicle registration must be transferred to the new owner as well. Draw up a bill of sale that states the year, make, model, and serial number of the car; the price paid; your name and address; the name and address of the buyer; and that the car is being bought “as is, where is, with no guarantee or warranty of any kind.” Federal law requires a statement of mileage, which you can include on the bill of sale. It should say: “The actual mileage on this vehicle, to the best of my knowledge, at the time of sale is ______“and put down the mileage showing on the odometer.

Make two copies of the bill of sale. You and the buyer should sign both copies; give one to the buyer and keep the other for your records. If your car is still under warranty, give the buyer the maintenance schedule. If you have a transferable extended service contract, give him this as well. In some states, license plates are transferable to another car; in others, they must be returned to the motor vehicle bureau. In either case, you will have to get a state form to send to your insurance company with your policy cancellation. You will also need to send back your insurance ID card in order to obtain a premium refund.

Driving costs/Buying a new car

Deciding on the make and model:

For most people, buying a new car is a major event and a relatively large expenditure. The final decision as to what car to buy should be based on intelligent research into the type of car you want or need, and the cars and prices available. This research takes a good deal of time, but it’s time well spent. Begin by analyzing the type of driving you generally do (i.e., city driving, short trips, or long trips) and determine how many passengers are usually in the car. Read the car ads and articles in auto magazines to become familiar with the various cars and options available. Narrow your choices down to a few cars of the same type and size that seem to fit your needs best.

Small cars are by far the most economical to buy, own, and operate, and modern small sedans have as much or more interior room than many larger cars. Small cars are excellent for normal commuting, they generally handle better than larger cars, and they are easier to drive and park. Large cars tend to give a better ride because of their longer wheelbase (the distance between the front and rear wheels), but large cars also consume more fuel and money.

Cars are classified into several size groups. The traditional auto industry method is to classify cars by wheelbase, but the U.S. Environmental Protection Agency (EPA) has devised a system based on total interior passenger and cargo volume. The EPA’s classes are: large (more than 120 cubic feet), such as the Lincoln Continental and Chevrolet Caprice; mid- size (110 to 120 cubic feet), such as the Dodge Aspen and Cadillac Eldorado; compact (100 to 110 cubic feet), such as the AMC Concord and Ford Granada; subcompact (85 to 100 cubic feet), such as the Dodge Omni and Volkswagen Golf/Rabbit; and mini-compact (less than 85 cubic feet), such as the Honda Civic.

Cars are also available in several body styles. There are station wagons, sedans, hatchbacks, coupes, convertibles, and roadsters. Station wagons have a large cargo area behind the passenger compartment, and either two or four doors; the rear seats fold down to increase this cargo space. Sedans have a closed cargo area separate from the passenger area, and two or four doors. Hatchbacks combine the styling of a sedan with the convenience of a station wagon’s opening tailgate and folding rear seat. They are sometimes called three-door or five-door sedans (the third or fifth door being the rear cargo hatch). Coupes are sporty two-door cars with room for either two adults or two adults plus two children. The latter models are called 2+2 coupes. A convertible has a folding top and room for four or more people; a roadster is a two-passenger convertible.

The number of doors a car has determines how easy it’s for passengers to get in and out of the rear seats. Four-door sedans with pillars between the doors are generally sturdier than other body styles. Some four-door sedans now have “childproof” rear door locks that prevent the door from being opened from inside the car. The sedan’s separate trunk area allows cargo to be concealed, a fact you should consider if you live in a high-crime area, though most hatchbacks have a removable security panel to conceal the contents of the cargo bin.

Once you have decided which type and size car best suits your needs, visit the showrooms to get some idea of the options and prices available. This is the time to start narrowing down your list to three or four choices. Ask your insurance agent if there are differences in the cost of insuring your choices.

Choosing options:

Almost every car make is offered as a base model about which price and fuel economy claims are made. The carmaker also offers more expensive trim levels plus a long list of optional equipment that allows you to outfit your car to your exact needs and taste. On some cat standard equipment may include a radio, air conditioning, automatic transmission, and power accessories. On “price leader” models, a rear seat and carpets may be extra-cost options.

The purchase price and the cost of owning and operating any car will depend on how you choose to equip it. In general, the larger the car and the more automatic its operation, the more expensive it will be to buy, operate, and maintain. The Gas Mileage Book prepared by the EPA compares the fuel economy and passenger room of all new models. You can obtain a copy from new-car dealers or by going to the U.S. Government’s useful site: fueleconomy.gov .

Engine: In general, the smaller the engine, the more economical it’s to operate and maintain. How ever, the power of the engine must be appropriate for the size and weight of the car. Too small an engine can prove less economical than a larger engine that does not have to work as hard to pull the same load.

The engine offered for the base model almost always has adequate power for safe passing or merging with highway traffic. But if you tow a trailer or load the car with power accessories, you will need a larger engine. When manufacturers offer a choice of three engine sizes, the medium-sized engine is usually the best compromise between power and economy.

---Manual transmission: A manual transmission allows more control of the car, especially on slippery roads. When used properly, a manual transmission is also more fuel efficient than an automatic. Manual transmissions are available with three, four, or five forward speeds. Five-speed transmissions usually have overdrive gearing, which saves fuel and reduces engine wear. A manual transmission is the most sensible choice for small cars.

---Suspension: This supports the weight of the car, cushions passengers from shocks, and provides stable handling. The standard suspension on most cars should be adequate for normal driving. If you intend to use your car on rough roads, for fast driving, or to haul heavy loads, you should order a heavy-duty suspension. Special trailer-towing packages usually include heavy-duty cooling, electrical, and suspension components; a trailer hitch; and a reinforced frame. Special police or taxi packages make for an unusually rugged car.

---Wheels and tires: Wider wheels and tires can sup port heavier-than-normal loads safely and provide extra traction and improved handling. Extra-wide tires may rub on the suspension and bodywork, so stick to the options offered by the dealer or factory.

---Brakes: There are two basic types of brakes: disc and drum. Disc brakes resist fading much better than drums and are standard equipment on most new cars. Power-assisted brakes don’t make the brakes work any better, but they do make it easier for you to push the brake pedal and are standard on many new cars.

---Steering: Power steering not only makes your car easier to steer, but because the steering ratio is quicker with power steering than with manual steering, handling is improved.

---Air conditioning: Air conditioning is either factory installed or dealer installed. Dealer-installed “air” may be up to $200 cheaper than a factory-installed unit. If you are paying the extra price for factory air, make certain that you get it. Salesmen tend to be vague on this point, but if they tell you that you are getting factory air and then install an aftermarket unit, that is fraud.

Any air conditioner will reduce the fuel economy of a car when the system is in use. All-season systems, in which you set a thermostat to the desired temperature, operate the compressor winter and summer, thereby increasing fuel consumption the year round. Many cars need a larger-than-standard engine to power the air conditioning. Tinted glass will keep the car a little cooler, thereby reducing the amount of work the air conditioner must do; but tinted glass also reduces visibility at night.

---Seats: Most cars offer a choice of seat type and seat covering. A bench seat has a single seat cushion and a single back cushion, both the full width of the car. A variation of the bench seat is the split bench, which is divided into two halves that can be adjusted individually. The bucket seat is a single seat meant for one person; two are placed side by side across the width of the car. On most cars each bucket seat can be individually positioned to fit the person sitting in it. The best bucket seats are shaped to provide side support for your torso when the car is cornering. The seat backs on better bucket seats also adjust to various angles or recline completely.

Vinyl is the most durable and easy to clean upholstery material, and is particularly recommended for families with small children. Fabric seats are more comfortable—cooler in summer, warmer in winter— but can be very difficult to clean. Leather is a luxury that is difficult to maintain and expensive.

---Rust-proofing: Although a tar-like undercoating is sold as a rust preventive, it may actually trap moisture against the chassis and promote rust. The most effective rust-proofing treatment is a waxy paste sprayed inside the body panels by an aftermarket specialist. He drills holes in hidden areas, sprays in the paste, then plugs the holes. Rust-proofing costs between $150 and $200 but carries a three-year to “lifetime” guarantee against rust-outs.

Silicone-based clear spray can be applied to your car’s paint to protect it against chemicals and pollution. Most silicone-based protectants are guaranteed for three years. This glaze is applied like old-fashioned wax in only a few minutes. Dealers charge $150 to do this; you can do it yourself for less than $30 by buying the clear spray at an auto supply store.

Getting the best price

The best deal on any new car involves three factors: the purchase price, the dealership, and the warranty. The purchase price is the most immediate cost, and you should try to get the most car for the least money. This will depend on a knowledge of the wholesale price of the car and its options. Retail, or list, price is only the manufacturer’s suggestion; the dealer can sell his cars for any price he wishes.

The dealer buys his cars at the wholesale price. The difference between the wholesale and list prices is the dealer markup. Markup on a small car is about 10 percent; markup on a large car is 20 to 25 percent; markup for options ranges from 25 to 100 percent.

Most cars sell for less than list price, although a few models may command more than list when demand is greater than supply. Most dealers expect to make $800 to $900 profit on each sale, though you can bargain your way down to $150 to $200 over wholesale. You can estimate the wholesale price by using the dealer markups. Subtract 10 percent from the list price—exclusive of options—on mini and subcompact cars, 15 percent on compacts, 20 percent on mid-size and large cars, 25 percent on “luxury” and sports cars. Subtract 50 percent from the list price of all the options added together. The total price of the car plus options will approximate the wholesale price. Add $350 to $500, and that is the price you should pay. You can get the price information you need from the window stickers on the cars in the dealer’s lot.

Shop several dealers and get written price quotes from each. The written quote should include a description and separate prices for the car and the options, sales tax, freight and delivery charges, and dealer’s preparation fees. Once you have a written deal, ask how much of a trade-in the dealer will give you for your old car. A valid trade-in allowance will be close to the wholesale value of your car. Have the trade-in allowance written into the pro posed deal after you get a price for the new car. Price quotes and final sales agreements are valid only if they ate written and approved by the sales manager; the salesman does not have the authority to approve a deal in most dealerships.

Ask your neighbors and the local Better Business Bureau about a particular dealer’s reputation for competent and honest service. Also consider the location of the dealership. An out-of-town dealer might have low prices but prove inconvenient for regular service or emergency repair.

If your choice is between two different car brands, look into the warranty offered by each company. A warranty is a guarantee covering the repair or re placement of specified parts within a limited time and mileage period. One warranty might guarantee that all parts, except tires, that prove to be defective under normal use within 12 months or 12,000 miles (whichever comes first) will be replaced or repaired free of charge. Another might guarantee fewer parts for a longer period of time.

You can also buy an extended service contract from most car manufacturers for around $200. This is a form of insurance that will pay for certain major repairs beyond the limits of the warranty that came with the car. The repairs covered vary with the contract, but many contracts cover only the engine and drivetrain for three years/50,000 miles to five years/100,000 miles. Most warranties and extended service contracts tie you to the dealer’s service department for as long as the warranty is in effect. A dealership service department is usually the most expensive place to have a car serviced.

Test-drive any new car you are considering. Make sure that the car is equipped with the same engine, transmission, and rear-axle ratio you plan to buy. If you test-drive a V-8 loaded with options but order a spartan car with a four-cylinder engine, your test drive won’t tell you much. Once you have made the decision to buy a specific car, the salesman will write up a formal sales agreement that should list all the options you ordered, the sales price, and all additional taxes and fees. This agreement should state that your deposit will be returned if the deal fails to go through or if you refuse to accept delivery of a car that is not equipped according to the agreement. Read the agreement carefully and have anything you don’t like changed or deleted. Once you and the sales manager sign the agreement, it’s final.

The window sticker lists all the options built into each car at the factory and their suggested prices. When your car is delivered, check the sticker against your sales agreement to make sure that the car has all the equipment you ordered, but no extra equipment that you did not order. Refuse to pay for options you did not order. Be sure to test-drive and inspect the car, and have any obvious defects corrected before you accept delivery.

Driving costs/Buying a used car

How to find a good used car:

The average new car depreciates more than 40 percent in the first 36 months; after that, the rate of depreciation tapers off to less than 10 percent each year. This makes a three-year-old car a particularly good buy; the price is comparatively low, but the car still has tens of thousands of miles of use left in it. The primary disadvantage of buying a used car is the risk of buying a lemon. Even the best used-car warranty lasts only 90 days, and it does not cover all the items covered by a new-car warranty. With a little home work, however, you can make a good used-car buy.

The first and hardest step in selecting any car, new or used, is determining the type and size car that most closely fits your needs (see Buying a new car). The next step is to find out which car has the best reputation for reliability. A car with a good reputation will usually cost more, but your chances of getting a lemon are proportionately less. As a general rule, the most practical used car is a four- door sedan with an uncomplicated medium-sized engine, automatic transmission, few power accessories, and no air conditioning. Read the frequency- of-repair surveys and owner’s reports in automobile and consumer magazines to narrow your choices, then ask local mechanics which cars give the least trouble and are easiest to repair.

Once you have settled on a particular model, do some research to determine its value. Consult the NADA Official Used Car Price Book or the similar Kelley Blue Book. Public libraries or banks that offer automobile loans often have these guides.

Most price guides assume that a car has automatic transmission and a radio. If a late-model used car has no stereo, you should deduct $60 from its retail value; if it has a manual transmission, deduct $175. If it has air conditioning, add $200 to $300. If it has power brakes, add $50; power steering, add $65. You should add proportionately less to the price of older cars.

Be sure to use the latest edition of any price guide; prices vary drastically depending on the time of year, availability of gasoline, the state of the economy, and the part of the country you live in. Prices are also dependent on the car’s condition. A car in bad condition is worth less than the NADA wholesale price; an excellent car is worth more than the NADA retail price. The best buy in a used car is a low-mileage model in excellent shape. The price “saving” between a poor car and a good car is often less than what it would cost to fix up the car in poor condition.

The best used cars, and the most expensive, are usually found on a new-car dealer’s lot. A new-car dealer does not normally have much space for used cars, so he auctions off the dubious trade-ins—cars that are too old, too exotic, or in need of extensive repair. Because the new-car dealer has his own ser vice staff, his used cars have usually been expertly repaired and should be ready for immediate use. You pay for this service, of course. The new-car dealer’s prices are invariably higher than those a used-car dealer charges. Any defects should be covered by a 90-day warranty and corrected by the dealer’s service department. A new-car dealer often makes a higher profit on a used car than he does on a new car, so the price of a used car is always negotiable.

A used-car dealer sells used cars only. He usually has a number of cars that run the gamut of price and condition. Some of his cars are the unwanted trade-ins from the new-car dealers. Others are bought at auctions or from individuals needing ready cash. Your best bet is to go to a reliable dealer who has been in business for many years. Depending on the dealership, the car may or may not need repairs or be covered by a warranty. The dealership may or may not have a service department.

Rental and leasing companies are another source of used cars. Rental cars get hard use from people who often treat them poorly, and the maintenance may be hit or miss. Because of this, rental cars have a bad reputation and usually sell for bargain prices.

Used cars can also be bought from private sellers. Prices should always be lower than those a dealer charges, but obviously there is no dealer to complain to if the car proves faulty. Unless you can prove deliberate fraud, there is no legal recourse for a lemon purchased from a private party. Experienced buyers spend 25 percent less than they can afford for a used car except when they buy from a new-car dealer. This 25 percent is budgeted for the inevitable repairs the car will need within the first year or so.

Some used cars may still be covered by the manufacturer’s original warranty or by a dealer’s used-car warranty. Any used-car warranty should cover 100 percent of the cost of parts and labor. Don’t settle for a 50-50 warranty, which covers only half the cost; bills can be padded to have you paying for all the work. As with any warranty, you should bring your car back to the dealer as soon as a problem arises. If the car is not repaired satisfactorily, bring it back as often as you have to until the car is fixed.

Extended service contracts, sometimes called ex tended warranties, are popular options on both new and used cars. These are not true warranties, just a form of insurance on your car. Their terms and prices vary widely, but most contracts cover only the engine and drive train. Some policies require that the work be done by the dealer who sold the car; others allow for repairs nationwide. There are scores of companies selling this service insurance, but not all of them are likely to remain in business. The safest policies are those issued by the car manufacturers.

Before buying any used car, check to see if that model has been recalled and if the particular car has been repaired. If the owner cannot tell you, call the manufacturer’s customer service office. If you give them the car’s vehicle identification number, they can tell you if that particular car was recalled and fixed. The National Highway Traffic Safety Administration (NHTSA) maintains a website for recall information: www.nhtsa.gov/Vehicle+Safety/Recalls+&+Defects . Find out from the manufacturer or NHTSA what the recall was for. A simple fault may not bother you; a serious design defect is a good reason to buy a different model.

A car is assumed to last 10 years or 100,000 miles, whichever comes first, though well-maintained cars can last more than 100,000 miles. A three-year-old car with 60,000 miles is considered to be the equivalent of a six-year-old car and will sell for less than a similar car with 30,000 miles on it.

Every time a car is sold, the seller must give the buyer a statement certifying the actual mileage on the car. Ask the seller to show you the mileage statement he got from the previous owner. This helps to discourage odometer tampering. If you see scratches on the odometer face or holes in the plastic lens over the odometer, be suspicious. While making your road test, check to see that the odometer numbers move smoothly and properly.

On Chrysler cars an ink pad colors each ten-thousandth digit after it comes up on the odometer. If you see a blue ten-thousandth number, the odometer has turned over 100,000 or it has been set back. On GM cars, white lines show up between the numerals if the odometer is tampered with. Ford and GMC odometers simply break if they are turned back.

Road testing a used car:

The typical used car is sold because it needs a major repair or because the owner thinks it will soon need repairs. This in itself is no reason to avoid a used car. Anything can be fixed if you spend enough money. There are three things to determine before you buy any used car: Exactly what is wrong with the car? How much will it cost to repair? Is the price of the car, after adding the cost of repairs, still reasonable?

Road test a used car as you would a new one. Are the seats comfortable? Do the ride, handling, and performance meet your standards, and is this the type and size car that best meets your special requirements? When you find a car in which you are seriously interested, take it to your mechanic for a thorough test. He can spot problems and give an estimate of how much it will cost to correct them.

Visual test: Never try to buy a used car at night; you need sunlight to spot defects or poor repairs.

1. Bodywork is expensive, so start by inspecting every corner of the car for rust, dents, signs of repainting, or worn-out old paint. Cars rust from the inside, so surface blisters in the paint are usually an indication that a panel is about to rust through completely. Tap with your fingers along the bottom edge of the body all the way around. Solid metal bodywork will have a metallic ring; quick repairs with plastic body filler will give a dull tap; rusted-out panels will feel spongy or loose. Slide under the car and check the floorboards for rust, too. File marks, paint overspray, or paint shades that don’t quite match on adjacent panels mean that the car has been in an accident and was inexpertly repaired.

2. Roll all the windows up and down. Open and close the doors, trunk, and hood. Lock and unlock the doors, using both the outside key lock and inside door lock. If any door or lid does not fit properly, it may indicate that the car has been hit and that the frame or body is permanently bent. Poor window seals and door locks can be expensive to repair.

3. Inspect the tires for uneven wear, which can indicate a bent frame or worn-out suspension. Be suspicious of brand-new tires on a used car; the old tires may have revealed major problems that the owner wants to conceal. Perhaps the shocks are bad, the wheels are out of alignment or bent, or the car was in an accident. If there is excessive tire wear but the odometer shows only low mileage, suspect that the odometer has been tampered with. If the tires have uneven wear and the car shows signs of accident repairs, the frame is probably bent.

4. While inspecting the front tires, grab the top of each wheel and pull it in and out. If there is excessive movement or noise, check for worn suspension and wheel bearings.

5. Test the shock absorbers. Push down each corner of the car several times, then release it. If the car bounces up and down more than twice, you may need new shock absorbers.

6. Examine the engine for excessive fluid leaks. If not the result of an actual crack or faulty seal, a leak could still mean that the car has not been well maintained. Also check the battery and radiator for cracks and proper fluid levels. Oil in the radiator coolant is a sign of a cracked block, blown cylinder head gasket, or leaking transmission cooler. Anti freeze in the automatic transmission fluid means the cooler is leaking. Also check the oil dipstick. Black sludge is a sign of neglect. Water droplets or gray foam in the oil mean that the block has cracked.

7. Check the trunk area for rust, a working jack, and a spare tire. Excessive wear in the trunk or cargo area could mean that the car was used to carry heavy loads, which ages a car quickly.

8. Check out the interior for wear on the seats, floor mats, and pedals. Look for water marks and musty odors, rust, sand under the rugs, and corrosion of electrical connections—all signs that the car was in a flood. Don’t buy a car that is flood-damaged.

9. Press down on the brakes. If the pedal goes too low or sinks to the floor, it means that the hydraulic system is defective. If the brakes feel spongy, it could mean that there is air in the system.

10. Check the entire exhaust system. Holes or patch jobs indicate a system that needs to be re placed—a job that can cost over $200 on some models.

Road test: If the car has passed its visual inspection, and its estimated repair bill seems reasonable to you, take it for a road test. If the owner won’t allow you to road test a car, don’t buy it.

1. When you start the engine, listen for unusual noises that can indicate expensive engine repairs. Try all the accessories at the same time and make sure that they all work. Check the am meter to see how well the battery and alternator take the excessive load when everything is working at once. Have a friend stand outside the car to see if the exterior accessories and lights work properly. If they do not, it may be something as simple as a burnt-out bulb or as complex as an electrical circuit problem.

2. With a friend watching as you drive away, drive slowly in a straight line. If the car travels at a slight angle, it indicates that serious frame damage from an accident has not been repaired properly. Have your friend watch the wheels and tires to see whether they wobble as you drive—a sign of suspension trouble or bent wheels. Have him look for smoke or leaks, too.

3. Accelerate under different road conditions. See if the car picks up speed smoothly. If the engine hesitates, bucks, or makes strange noises after it has warmed up, repairs may be needed. While accelerating and after accelerating, look for smoke from the exhaust. Blue smoke indicates worn piston rings or valves. Black smoke means that the carburetor may need overhaul or replacing. White smoke may indicate a blown head gasket.

4. Check the transmission. Put the car into all gears, including Reverse. Noise, slippage, or inability to shift means transmission trouble.

5. Check the brakes. When pressure is applied, the car should stop smoothly, in a straight line and without grabbing. Try the parking brake on a grade to make sure it works.

6. Check to see how well the car steers and responds in sharp turns. The steering should not be loose or sloppy; the car should respond immediately.

7. Test the suspension by driving over a bumpy road. The suspension system may need repairs if the car squeaks or rattles, if you have trouble steering, or if the car bounces excessively. If the car wallows long after hitting a bump, the shock absorbers are worn out. Don’t confuse ride (the com fort of the car on bumpy roads) with handling (the way the car responds on turns).

8. At the end of the road test, try to restart the engine while it’s hot. Inspect the engine compartment and the underside of the car for leaks.

Mechanic’s test: If the car passes your road test and visual test, have your own mechanic check it over. His services will cost you money, but in the long run it will be worth it. Tell your mechanic what you think is wrong with the car. Ask him to inspect the spark plugs and to perform a wet and dry compression test, and a torque converter stall test. If the car has no oil-pressure gauge, have him test the oil pressure.

Driving costs/Financing

Shopping for the best car loan:

When shopping for any car, new or used, you should also investigate the different methods of financing it. Often, the money saved by shopping for the lowest car price is lost on needlessly expensive financing.

The simplest method of financing, of course, is to pay cash. The chief advantage of this method is that the car is completely yours. Paying cash, however, has its hidden costs—the same amount of money left in a savings account would have earned interest or, if invested elsewhere, could have made a profit.

For most car purchases, money is borrowed from a bank or another lending institution. There are several types of loans, and each carries an additional cost in the form of interest charged on the money borrowed. This interest charge is known as the annual percentage rate (APR); it’s the total amount of interest charged in a year.

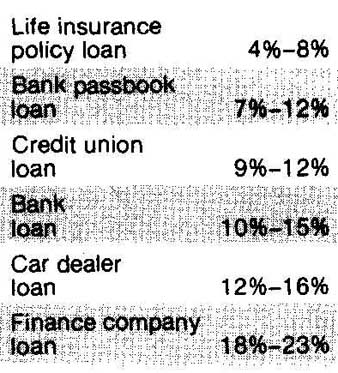

In general, the smaller the amount of money borrowed, the lower the APR charged; and the shorter the duration of the loan, the less the total cost of the loan. The total cost is the amount borrowed plus all finance or interest charges (see tables below). Be cause interest rates rise with inflation and differ between one lending institution and another, the only way to find the lowest APR available to you is to shop around among several lending institutions.

Other costs:

While shopping for a loan, ask about costs or fees other than interest charges. Usually you will be required to make a cash down payment that is equal to a percentage of the car’s purchase price. Some institutions will insist that you purchase credit life:

Table 4: Interest rates

Life insurance policy loan 4%—8%

Bank pass book loan 7%-12%

Credit union loan 9%-12% 12%

Bank insurance to pay off the outstanding balance of the loan in the event of your death. The premiums for this insurance are either separate from, or are automatically added to, the monthly loan payments. You will also be required to carry collision and comprehensive coverage (fire and theft) on your car insurance policy. If the lender can supply this coverage at a lower rate than your insurer’s, fine. If not, ask that they accept your insurer’s coverage. In no case should you pay for the same coverage from two insurers—they won’t pay twice for the same accident. Two other added costs might be a credit investigation fee or a loan application fee. Fees are not tax deductible; interest charges are. Also ask what the penalties are for late or skipped payments and whether or not there is a pre-payment penalty if you pay off the loan before it’s due.

Types of loans

The different ways of borrowing money are explained below. Whether or not all types are available to you will depend primarily on your credit rating.

Pass book loans are available from a bank where you have a savings account. Your savings account must contain at least an amount equal to the loan plus the interest and finance charges. While you are paying back the borrowed money, the money in your savings account is gaining its normal rate of interest; so even though you are paying interest charges on the loan, you are accumulating interest on the money in your account. The actual cost to you is the difference between these two rates. A pass book loan is one of the cheapest loans available to many people.

An amount equal to the outstanding loan must re main in your savings account until the loan is repaid. This money acts as collateral; that is, if you default on the loan, the bank will deduct the outstanding amount from your savings.

---Borrowing against life insurance: This method applies only to whole life insurance policies that have a built-up cash value. If you have such a policy, you can borrow from the insurance company against the accrued cash value (not face value, the amount paid in case of death). You pay interest charges on the unpaid balance along with your regular premiums. (The APR of the loan was determined the first year the insurance policy was issued, so the interest could be very low by current standards.) You don’t have to replace the money borrowed, but if you do not, the balance of the unpaid loan is subtracted from the death benefit paid to your beneficiary.

---Loans from credit unions: Credit unions are non profit organizations, run by some employers or trade unions, that lend money to their members. Interest rates will vary with the organization, but they are usually lower than those of commercial banks. If you belong to a credit union, shop for a better deal elsewhere before you make your decision.

---Bank loans: The APR on a loan from a commercial bank can vary greatly from one bank to another. You should go to several in your area and compare their rates. Rates from commercial banks are usually higher than those of savings banks or credit unions. The car serves as collateral for the loan.

---Loan companies usually offer loans at higher rates than commercial banks do, often to people with poor credit ratings. Since a predictable number of people will default on these loans, the loan companies must charge a rate high enough to cover their losses.

Loans from car dealers or auto manufacturers:

With this type of loan you are paying the cost of a middleman. The middleman is the car dealer; he arranges for a loan from another lending institution and then charges you those fees plus an additional one for his time and effort. The only advantage to a dealer loan is that it may be offered to people whose credit rating is not good enough for a bank loan.

---Personal credit cards: Most cards extend a line of credit from $500

to $5,000. The amount of credit will vary with the card, but the APR

is usually close to the maximum allowed in your state.

Table 4: Interest rates

Table 5: 1 Interest charges on a $1,000 loan

1 YEAR---2 YEARS---3 YEARS---4 YEARS

APR Monthly Total Monthly Total Monthly Total Monthly Total payment Interest payment Interest’\ payment Interest * payment Interest *

The total Interest charge does not represent the APR times the number 01 months the loan runs (10% 01 $1000 x 12, br example) Interest is charged each month only on the amount 01 the loan outstanding.

Leasing versus buying:

There are three types of auto leases: closed-end leases, open-end leases, and maintenance leases.

With a closed-end lease—also known as a net, fixed-cost, or walk-away lease— you (the lessee) con tract with a leasing company (the lessor) to rent one of their cars for a certain length of time. At the end of that time, you return the car. The lessor sells the used car and either makes or loses money, depending on the car’s resale price. A calculation of the resale price, made at the beginning of the lease, determines the monthly leasing fee. If the actual resale price is more than the amount predicted, the company makes a profit; if the resale is less than predicted, the company loses money. With most closed-end leases there is an additional fee for any excess damage and/or mileage on the car at the end of the lease period.

With an open-end lease (also known as a finance or equity lease) you have an option to buy the car at the end of the lease period. You are not charged for excessive mileage or damage. It’s to your benefit, however, to treat the car well, because the monthly payment is affected by a predicted resale price. This is the price at which you can exercise your option to buy the car. If you don’t want the car, the leasing company will sell it. If the actual resale price to a third party exceeds the predicted resale figure, you receive the difference; if it’s under the predicted price, you must reimburse the lessor.

A maintenance lease is an expensive type of closed-end lease in which some or all of the car’s maintenance is taken care of by the leasing company.

Be sure you know what all the fees are in any lease agreement. The nominal monthly fee may or may not include sales tax, registration fees, and insurance premiums. Ask the lessor if you are required to carry specific insurance coverages. If the lessor offers insurance, find out the exact coverages and costs to determine if the same coverages are available else where for less. An advance payment or a security deposit may be required. Find out if it’s in addition to the monthly payments or whether it will be refunded at the end of the lease.

Look into the penalties. If the lease includes charges for excessive damage or mileage, know what the charges are and exactly what the lessor considers excessive. Know the conditions for terminating the lease and what happens if the car is damaged or destroyed. Have all the details put in writing.

Many times, the decision for or against a lease is based on how its monthly charges compare to those of financing the money for the outright purchase of a car. The table below shows how to compare these costs. 1 the payments for a three-year lease add up to the full new-car price, in this case 36 payments of $222. If a $500 deposit is required in advance, and this money is taken out of a 7 percent savings account, $113 in interest will be lost over the three-year period (line 3). However, you won’t have to pay income tax on that $113, which would save a person in a 30 percent tax bracket $34 in income taxes ($113 times .3), as shown on line 4. The sales tax is also deductible from your gross income in income tax calculations—in this case saving $400 times .3, or $120. Line 6 determines exactly how much the lease will cost you. If there are no penalties for damage or mileage, and the car is sold for $500 more than its estimated resale value, that amount is refunded to you. If there are penalties, add them to line 6.

To finance the same car over a three-year period, it was assumed that the buyer put $2,000 down and borrowed $6,000 over three years at an annual interest rate of 13 percent. That would result in a finance charge of $1,278. Over the three-year period, $240 in savings bank interest would be lost on the $2000 down payment (line 11). Income tax savings on this lost interest are $240 times .3 for a person in a 30 percent tax bracket. The finance charges are also tax deductible (line 13).

If the three-year-old car can be sold for $3,760, this amount can be deducted from the cost of ownership for three years. All maintenance, insurance, and other costs for the two cars were assumed to be equal.

To fill in the blanks for your case, you must enter the actual costs and charges for leasing or financing the car you want, then estimate its resale value in three years. A leasing company should be glad to give you their estimate.

Leasing is more expensive than buying. It makes sense only for people who use a car for business and can deduct its cost from their taxes. The lease payments become a simple form of record keeping that is seldom questioned in tax audits.

Table 6: Leasing vs. buying costs over three years

Open-end leasing costs for three years | Sample case | Your case

1.36 monthly payments, plus down payment (if any) $8,000 $

2. Sales tax on monthly payments + 400

3. Interest not earned on any cash used for down payments or deposits

4. Tax savings on interest not earned (line 3 x your tax bracket)

5. Tax savings on sales tax (line 2 x your tax bracket) — 120 — ______

— 500 +1— _____

6. Surplus (—) or penalty (+) from resale of car

Total Cost: $7,859 $

Financing costs for three years | Sample case | Your case

7. Purchase price minus down payment

8. Down payment

9. Sales tax on purchase price and down payment

10. Finance charge on 36 monthly payments

11. Interest not earned on cash used for down payment

12 Tax savings on interest not earned (line 11 x your tax bracket)

13. Tax savings on finance charges (line 10 x your tax bracket)

14. Resale value of three-year-old car

Total cost: $5,618 $

Driving costs/Fuel

You are the best gas-saving device:

The best way to save fuel is to drive smoothly and avoid fast starts and sudden stops. Keep an eye on traffic ahead of you. When you see a blockage, coast toward it rather than driving up at high speed, then slamming on the brakes. Avoid unnecessary stops; it takes 20 percent less gas to accelerate to cruising speed from 5mph than from a full stop.

On the highway, maintain a steady speed. Varying speed by only 5 mph can cost 1.3 miles per gallon (mpg). Stay off the brakes except for emergencies. Steer around slower cars whenever possible, rather than first slowing to their speed, then accelerating past. If you are going too fast, release the gas pedal and coast down to a lower speed, without braking. Keep windows closed at high speeds and use the dash vents for fresh air—vents are quieter and cause less drag. Turn off the engine whenever you will be stopped for more than a few minutes, whether at a store or in a traffic jam. An idling engine can use up to a pint of gas every 5 minutes. Don’t let the car idle to warm up the engine. Drive off immediately after starting, but at a low speed. The engine will warm up faster and lubricate better. Keep the engine in tune— a well-tuned engine won’t only use less gas, it will start at the first flick of the key.

Never fill the gas tank to the brim. The gas is likely to spill out when the tank is being filled, if you later park facing uphill, or if the sun expands gas that was pumped up from a cold underground storage tank.

Because of differences in rolling resistance, radial tires can save 1 mpg compared to conventional tires, while snow tires can cost you 1 to 3 mpg. Check tire pressures often. A tire that is 8 psi low will cut fuel economy by 2 mpg. Boosting tire pressure 3 to 5 psi above the recommended level will save gas and improve handling, as long as you don’t exceed the maximum pressure listed on the tire sidewall.

Always keep a manual transmission in the highest gear possible without straining the engine. Traveling at 50mph in Fifth gear (2,500 rpm) uses less gas than traveling at 30mph in Third (also 2,500 rpm) because the engine turns fewer revolutions per mile.

Don’t try to accelerate once you are on a hill and find your speed lagging. Anticipate hills and accelerate to a safe but adequate speed before the incline.

Caution----Never coast downhill in Neutral to save gas. You may reach dangerous speeds or overheat the brakes while trying to keep your speed in check.

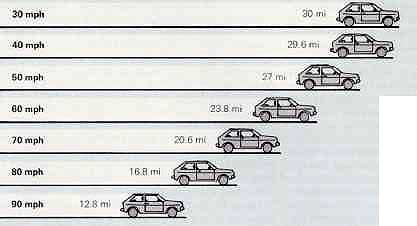

How speed affects mileage:

30mph 30mi

40mph 29.6mi

50mph 27mi

60 mph 23.8mi

70mph 20.6mi

80 mph 16.8mi

90mph 12.8mi

As speed increases, more power is needed to push a car forward through the air. More power requires more gas, so that fuel economy decreases as speed goes up. This drop is most dramatic in Small economy cars with good mpg averages. The figures at the left represent the actual distances traveled on one gallon of gas, at varying speeds, by a four-cylinder economy car in high gear.

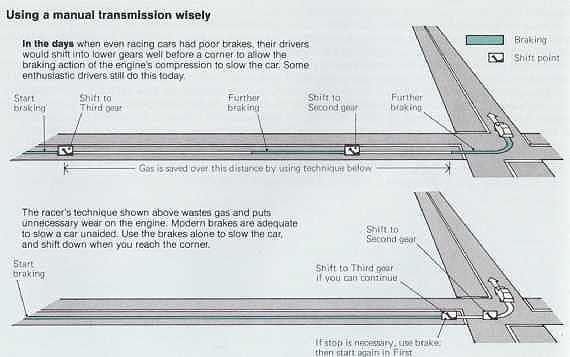

Using a manual transmission wisely---In the days when even racing cars had poor brakes, their drivers would shift into lower gears well before a corner to allow the braking action of the engine’s compression to slow the car. Some enthusiastic drivers still do this today.

The racer’s technique shown above wastes gas and puts unnecessary wear on the engine. Modern brakes are adequate to slow a car unaided. Use the brakes alone to slow the car, and shift down when you reach the corner.

Using aerodynamics to save fuel:

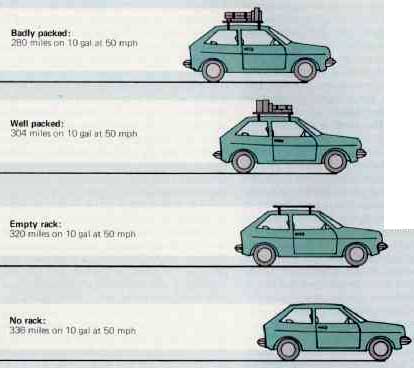

Aerodynamic drag of a roof rack will increase gas usage. The size of the increase depends on the speed of the car and on how well the rack is packed. A poorly packed rack will raise fuel consumption by 12 percent at 20 mph and by 25 percent at 70 mph. A well-packed rack will increase gas bills by 8 percent at 20 mph and 15 percent at 70mph. Even an empty rack will increase fuel use by 5 percent at 20 mph and 6.5 percent at 70 mph. Use a removable rack, and take it off when it’s not needed.

Badly packed: 280 miles on 10 gal at 50mph

No rack: 336 miles on 10 gal at 50mph

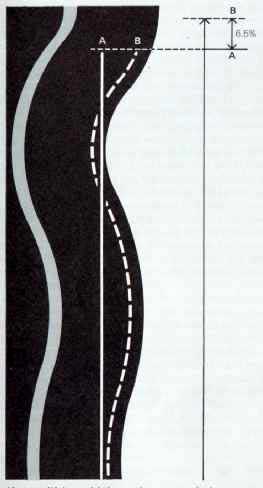

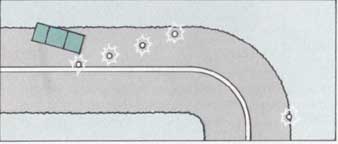

“Straightening out” a one-way highway

If a multi-lane highway is uncrowded, you can straighten it out.” Instead of following every zig and zag in the road, follow as straight a path as possible, cuffing from curb to curb if necessary. (Be sure always to signal lane changes, keep a careful eye out for other cars coming up behind you, and never cross a yellow line into oncoming lanes.) This will reduce the actual distance you travel from highway entrance to exit and the amount of fuel you consume. On the road pictured above, the difference in length between routes A and B is 6.5 percent.

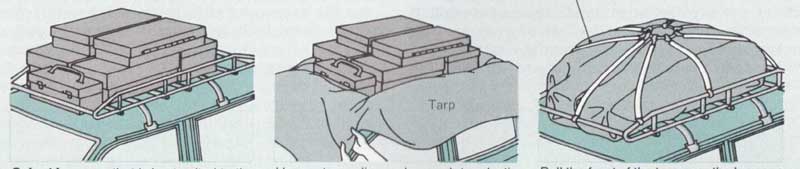

How to load and wrap a roof rack

Select luggage that is best suited to the size and shape of the roof rack. Arrange it in ‘steps,” with the lowest items at the front of the rack. Pack these bags with things you won’t need until you reach your destination.

Use a tarpaulin or heavy-duty plastic sheet 2½ times longer and wider than the rack. Lay it in the rack so that it’s centered from side to side, but most of its length hangs over the windshield. Arrange packed bags as planned.

Pull the front of the tarp over the luggage and tuck it in securely at the back. Fold down the sides of the tarp as you would a bed sheet and tuck them in so that the wind cannot get underneath. Secure with a rope or elastic “spider.’

Driving costs/Road emergencies

Getting a car off the road:

No matter how well you maintain your car, it’s not immune to a sudden mechanical failure. No matter how carefully you drive, you are not immune to an accident. The best you can do is to be prepared to handle any road emergency that might arise. Handling road emergencies properly will help to prevent further damage to you and your car, thereby keeping the resulting costs to a minimum. The most important procedure in any emergency is getting your car safely off the road or, if the car is immobile, protecting it and yourself from further harm.

---Getting a car safely off the road: Carefully slow down and signal your intention. If you have emergency flashers, use them as you slow down, and indicate turns by hand signals. Ease the car off the road and position it far enough away from traffic so that there is plenty of room to work on the car safely, if necessary. Turn off the engine. If it’s dark out, turn on the interior and exterior lights. If you need mechanical assistance, you can do one of three things: If you know the location of a call box, lock the car, walk to the call box, and phone for assistance. If you know the neighborhood and know the location of a gas station, lock the car and walk to the gas station. If you cannot go to a call box or a gas station, open the hood of the car, tie a white cloth to the antenna or to the door handle nearest traffic, and wait for help.

---If you cannot get the car off the road: Turn off the ignition and get everyone out of the car. Turn on your emergency flasher lights. If it’s dark, keep interior and exterior lights on. Set up flares or reflective warning devices about 20 feet apart in a row extending 100 feet behind the car, as shown below. Don’t set flares where they might ignite spilled gas or oil. If any curve or hill within 200 feet of your car will prevent oncoming traffic from seeing your first flare, place another flare over the hill or around the curve. Seek help as described above.

What to do in case of an accident:

In the event of an accident, it’s very important that you think clearly and remain as calm as possible. Immediately after the accident, stop your car. Get the car safely off the road, if possible, and turn off the ignition. If you cannot get off the road but no one is seriously injured, get everyone out of the car and to safety. If you are trained in first aid, treat injured persons until professional help arrives. As a general rule, don’t move an injured person; by doing so you could cause a more severe injury. Only in a dire emergency should you attempt to move an injured person. Such an emergency would be if there is a fire, if gas is leaking from the car, or if a person has been thrown into the path of oncoming traffic. Take care that you are not injured in the rescue attempt. Remember that you can be sued if the rescue aggravates the injuries of an accident victim.

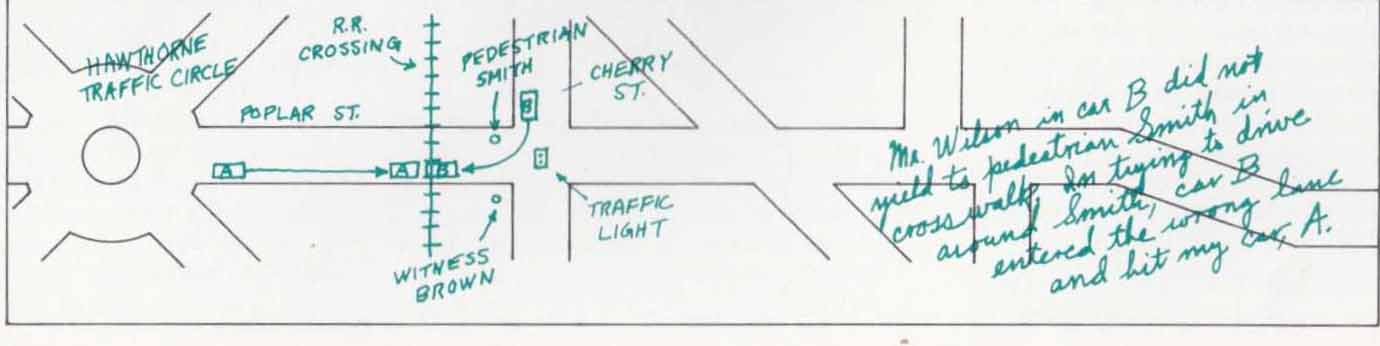

After the injured have been tended to, make a sketch of the accident scene (below); you will need this sketch later to file an accident report. Note the position, direction, and approximate speed of each of the vehicles before and after impact, and what happened at the point of impact. You should also record the length and direction of any skid marks, the road and weather conditions, the physical layout of the road, and the time and place of the accident.

Follow the instructions on the opposite page for getting off the road. Call for the police. Call the fire department if there is a fire or leaking fuel. Call an ambulance if there are injuries. If you cannot go for help, flag down several passing motorists and ask them to go for help; note their license plate numbers, if possible, for your accident report.

Get the names and addresses of all those involved in the accident, including witnesses. Describe each of the cars involved and note the extent of the damages to each car (including your own). Write down the name and address of each person injured, the apparent extent of the injuries, and which car each injured person was in.

The drivers of the cars should exchange driver’s licenses and registrations to get the following data:

name; address; date of birth; the number and expiration date of the driver’s license and car license plate; and the make, model, color, and year of the car. Drivers should also exchange insurance identification cards in order to copy the names of the insurance companies and the policy numbers. The police should be given the same information. You should record the name and badge number of each officer on the scene. Under no circumstances should you admit or deny fault for the accident to anyone, including the police; determining fault is up to the courts.

Most areas require that an accident report be filed with the local authorities. Ask the police or your insurance agent whether or not you must file such a report, and how much time you have for tiling. You will also have to file an accident report with your insurance company, whether or not you intend to claim any damages or sue other parties. Both these reports may be introduced in court, so they must agree in every detail. If the accident resulted in only minor damages to your car, it may not be worthwhile to file a claim for damages. If you have $100-deductible coverage and the damages amount to $120, you will be reimbursed $20. But by filing a claim, you risk that your premiums will be increased by an amount higher than the reimbursement.

If you are in doubt about filing a claim, ask your agent to do a cost

analysis to see how a particular claim will affect your insurance costs

over the next few years. When filing a report, make sure your insurance

company knows whether or not you are claiming any damages for your car.

It’s a good idea to keep a copy of any report you send to the authorities

or your insurance company for your records.

---If you cannot get off the road, set out flares as shown.

---Insurance and police: reports usually have an all-purpose map such

as this one so that you can make a sketch of the accident scene (shown

in color), Make your own sketch at the accident scene, including locations

of all the vehicles and witnesses involved, plus other pertinent facts.

Mechanical breakdowns:

---Flat tire or blowout: If a tire is going flat, you may have difficulty steering the car, the ride may feel sluggish or bumpy, or the car may handle erratically in turns or tilt down toward the flat tire. A blowout happens suddenly. In either case, grip the steering wheel firmly, and gently apply pressure to the brakes; don’t slam on the brakes. Pull off the road to change the tire. If necessary, drive slowly until you reach a spot where you can safely pull off the road.

---Out of gas: If the engine begins to miss or sputter, you may be running out of gas. Check the fuel gauge. If it reads Empty, put the transmission into Neutral so that you can coast, and assess your situation. If you are on a road where you are likely to find a service station in a few miles, employ all the fuel saving tips given on pages 20 and 21. Pull onto the shoulder or slow lane of a multi-lane highway and switch on your emergency flashers. Gently accelerate to 30 mph if you have an automatic transmission, then shift into Neutral and let the car coast until it slows to 10 mph, then gently accelerate back to 30 mph. If you have a stick shift, coast downhill when ever possible, but don’t let the car slow so much that you are forced to shift out of High gear.

If the road is clear of other traffic, wiggle the steering wheel to slosh extra fuel toward the pickup inside the fuel tank. Don’t shut the engine off when coasting; it may be difficult to restart.

If you are not likely to find fuel on the road you are traveling, pull safely off the road before you run out of gas, then call or signal for help. If the car won’t restart after it runs out of gas, remove the top of the air cleaner and pour just a few drops of gas into the carburetor, then start the engine. Repeat this procedure until the engine runs without stalling.

Caution: Don’t drip fuel onto hot engine parts because a fire may result.

Overheating: The signs of overheating are: steam coming out from under the hood, a temperature gauge registering hotter than normal, or the temperature warning light coming on. Pull the car off the road, let the engine cool down, and find the cause of the problem.

---Oil-pressure light comes on: The oil-pressure light comes on momentarily when you start the engine. If it stays on, or comes on while you are driving the car, it could mean that the oil pump has failed or that there is not enough oil in the engine. Stop the engine immediately, coast to a safe spot off the road, and check the oil level. Add oil if necessary. If the oil level is satisfactory, suspect a bad oil pump.

---Alternator warning light comes on: This light signals a malfunction in the electrical charging system, usually in the alternator or the belt driving it. Don’t stop the car; you may not be able to get it started again. Instead, turn off all unnecessary electrical equipment and drive to the nearest gas station for help. You should be able to drive a few miles on the electrical reserve in the battery.